Redefining Stablecoin Paradigms on Stability, Risk-Reward Distribution, and Transparency: A Deep Dive into International Stable Currency (ISC)

Table of contents

- I. Unveiling the Cracks: Challenges in Current Stablecoin Paradigms

- II. ISC: Challenging Current Stablecoin Paradigms

- III. Paradigms and Paradigm Shifts

- IV. How to get $ISC and $IGT

- V. ISC for Building Through Volatility

- VI. ISC's Approach to Potential Challenges

- VIII. Closing Thoughts

- Resources

Stablecoins, without a doubt, represent one of the most compelling and promising use cases for the world of cryptocurrencies.

They emerged as the bridge between the traditional financial system and the transformative potential of cryptocurrencies.

You know it.

If it’s your first time getting your hands into crypto, you’ll most likely do so by converting your fiat into a stablecoin.

They also marry price stability with the benefits of blockchain technology.

Because if you need a calm into the crypto world's volatility, you would usually convert your crypto into stablecoins to go stable.

But while stablecoins have gained the recognition it deserves, it's important to acknowledge the challenges and areas for improvement in the current landscape.

I. Unveiling the Cracks: Challenges in Current Stablecoin Paradigms

With the top stablecoins in mind, let’s highlight three paradigms on stablecoins today:

Stability is knowing you'll get the same dollar value for your money

More risk for the users, more rewards for the issuer

Attestation as users' best shot at transparency

While these existing paradigms have laid the foundation for the success of stablecoins today, it is crucial to recognize their limitations and the potential problems they present.

Just because something is working doesn't mean there's nothing wrong, right?

Later on, we will explore each of these paradigms in greater detail and discuss how these paradigms fall short.

II. ISC: Challenging Current Stablecoin Paradigms

For now, let me introduce you to a new stablecoin that's attempting to introduce stablecoin paradigm shifts—the ISC.

ISC or International Stable Currency claims to be the holy grail of stablecoins in terms of stability, gains, and community oversight.

What sets ISC apart is its unique pegging mechanism to a diversified basket of real-world assets, making it a resilient and inflation-resistant currency. By reinvesting profits into the stablecoin, ISC provides users with the opportunity to participate in the potential growth of their investments.

Additionally, ISC goes beyond financial aspects by incorporating community governance and oversight. This empowers ISC users and fosters transparency, accountability, and collective decision-making within the ecosystem.

As stablecoins continue to gain prominence in the cryptocurrency space, ISC's transformative features present a compelling solution to the challenges faced by existing stablecoin paradigms.

Now, let's delve deeper into each of these paradigms and explore the paradigm shifts introduced by ISC.

III. Paradigms and Paradigm Shifts

III-A. Rethinking Stability: Beyond the Dollar Value

Paradigm: Stability is knowing you'll get the same dollar value for your money

ISC's Paradigm Shift: Stability is knowing you'll get the same purchasing power for your money, independent of any single currency's dominance

Stability Paradigm Against De-pegging [ ✅ ]

Top stablecoin issuers take pride in showcasing their stability against de-pegging, assuring users that their stablecoins are always redeemable for 1:1 U.S. dollars.

So in today's world of stablecoins, the concept of stability is often equated with maintaining a 1:1 peg with a fiat currency, which in most cases is with the U.S. dollar.

This perception has become deeply ingrained in our understanding of stability, so it seems that users have come to believe this as the ultimate measure of stability.

However, should stability not encompass more than just simply preserving the dollar value?

Because what about inflation?

And what if USD loses its dominance?

Stability Paradigm Against Inflation [ ❌ ]

As time passes, the purchasing power of the dollar may erode due to inflation. Users, seeking stability, should be concerned not only with the dollar value of their funds but also with preserving their purchasing power over time.

Stability Paradigm Against De-dollarization [ ❌ ]

In an evolving global landscape, the dominance of the U.S. dollar is not guaranteed indefinitely. As countries explore alternative currencies or decentralized digital assets, stablecoins tied solely to the dollar may face challenges in maintaining stability. Users need to consider the potential impact of de-dollarization on the stability of their funds.

In summary, stablecoins today have mechanisms for ensuring the peg is maintained but have no mechanisms to address inflation and potential de-dollarization.

Now, using the same criteria/questions we used for the top stablecoins today, let’s see how ISC's paradigm shift addresses stability against de-pegging, inflation, and de-dollarization.

ISC's Stability Against De-pegging [ ✅ ]

The ISC peg mechanism ensures that the $ISC price remains stable by adjusting the circulating supply based on the market price.

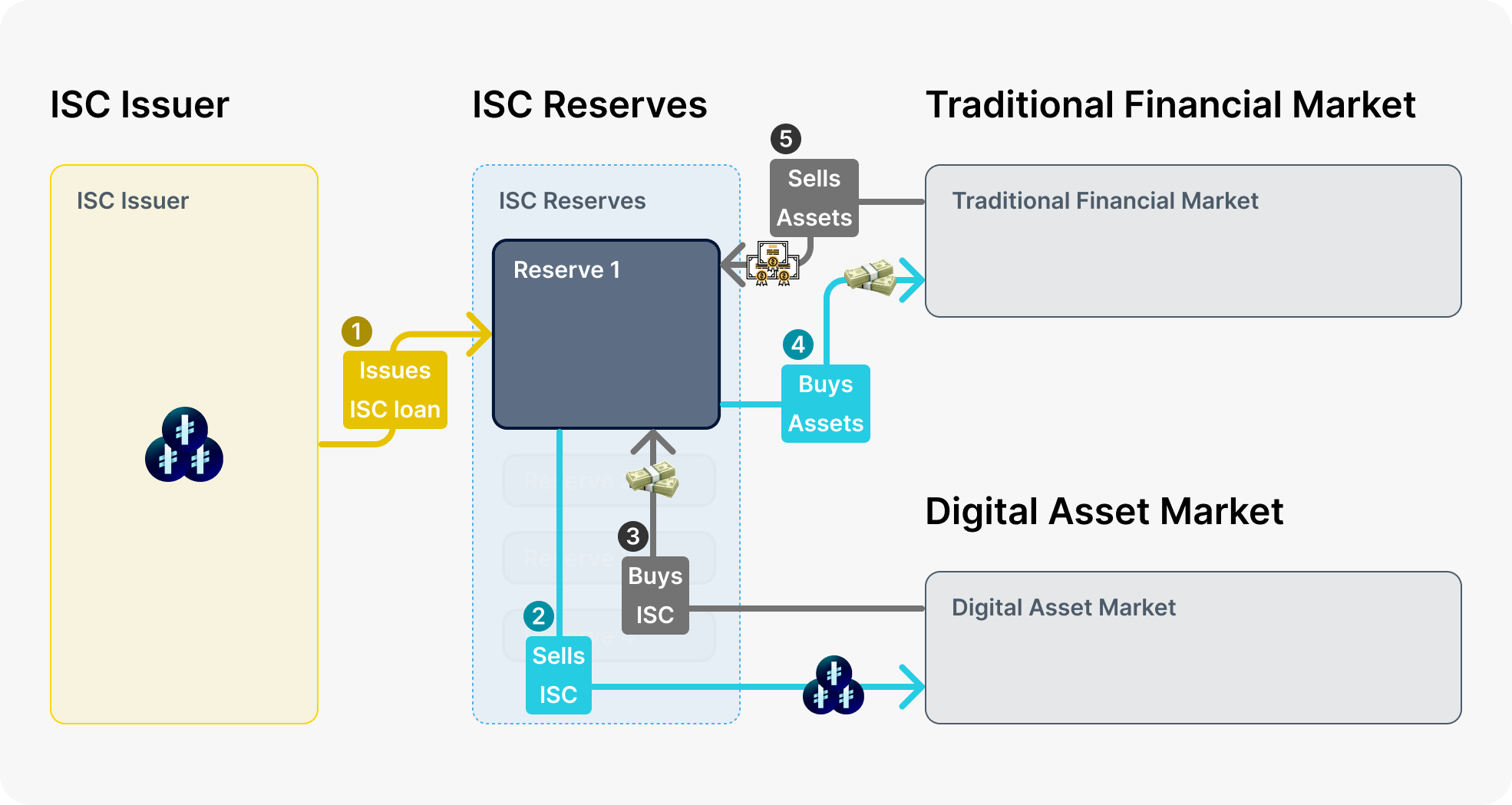

This is how it works:

Price Evaluation - The market price (the current trading price in the market) of $ISC is constantly monitored and evaluated against the target price (the desired price level for $ISC—see III-B Realigning Risk-Reward Distribution: A Fair Approach section for computation) to maintain stability.

Deviation Identification - If the market price of $ISC deviates from the target price, either higher or lower, it indicates a need for adjustment to restore stability.

Higher Market Price Scenario - If the market price of $ISC is higher than the target price, indicating an upward deviation, the following occurs:

a. Loan Issuance - The ISC Issuer loans more $ISC to the ISC Reserves.

b. Reserve Selling - The ISC Reserves, incentivized by the availability of the additional $ISC loaned by the ISC Issuer, may choose to sell these tokens into the digital asset market.

c. Increased Supply - With the ISC Reserves selling the additional $ISC, the overall supply of $ISC in circulation increases, potentially bringing the market price down towards the target price.

(Image Source: ISC Peg Mechanism)

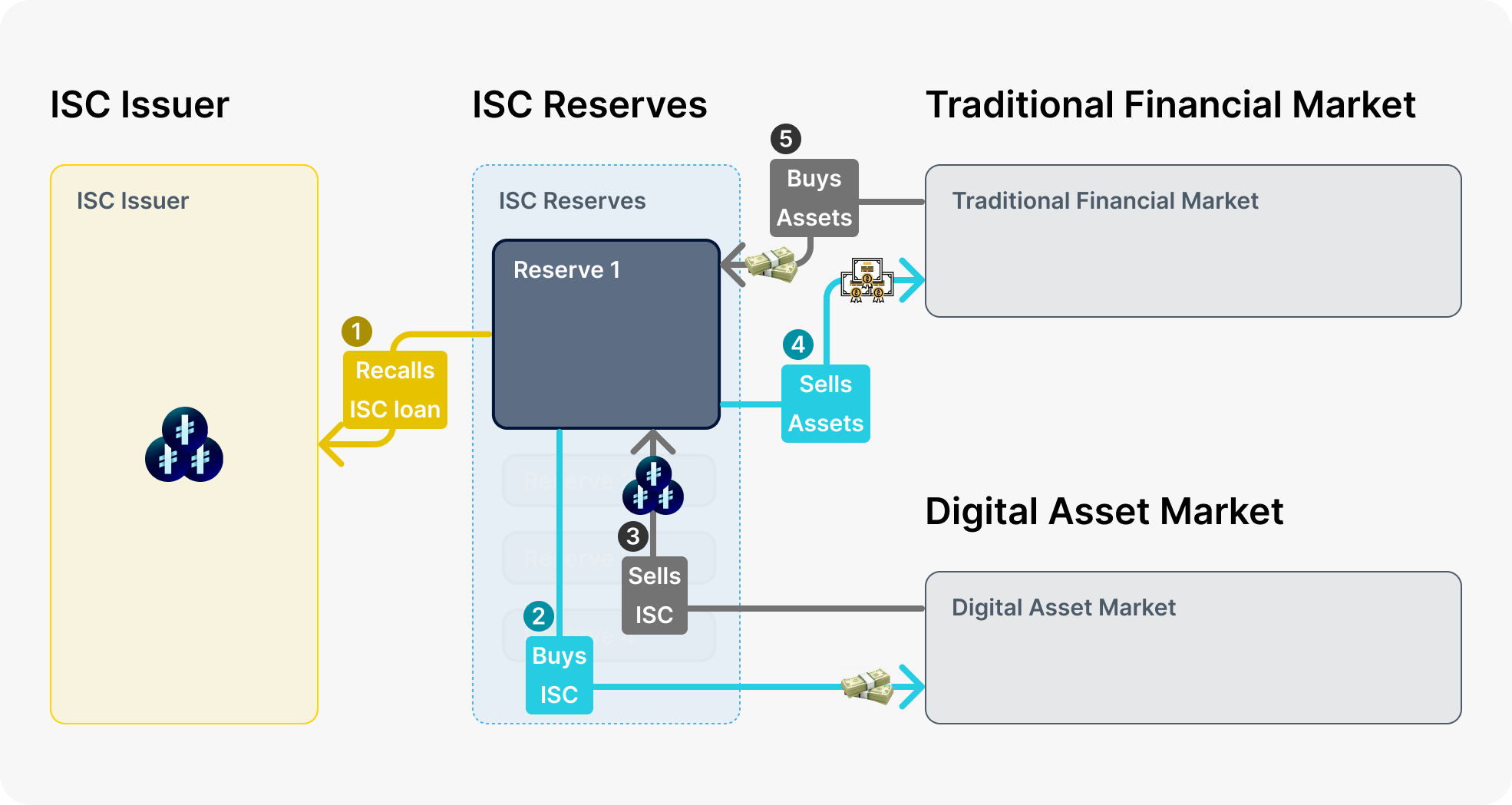

Lower Market Price Scenario - If the market price of ISC is lower than the target price, indicating a downward deviation, the following takes place:

a. Loan Recall - The ISC Issuer recalls existing loans of $ISC from the ISC Reserves.

b. Reserve Buying - The ISC Reserves are required to buy $ISC from the digital asset market in order to repay the recalled loans.

c. Decreased Supply - By reducing the $ISC held by the reserves, the overall supply of $ISC in circulation decreases, potentially pushing the market price back up towards the target price.

(Image Source: ISC Peg Mechanism)

Price Stabilization - Through the process of adjusting the circulating supply of ISC tokens via loan issuance or recall, the peg mechanism aims to bring the market price of $ISC back in line with the target price, thereby maintaining stability.

ISC Reserve Basket Daily Rebalance - On a daily basis, the ISC Reserves adjust the precise quantities of each asset within the ISC Reserve Basket to maintain its alignment with the community's desired asset allocation.

The ISC Reserves will be independently operated. Each reserve is tasked with providing liquidity of ISC to the Digital Asset Market, while also buying and selling assets from the Traditional Financial Market.

ISC's Stability Against Inflation [ ✅ ]

ISC backs its value with a diversified basket of real-world assets. To illustrate a diversified basket of real-world assets, ISC's Initial Reserve Allocation looks like this:

Equity, Global | 20% |

|---|---|

Commodity, Gold | 20% |

Bond, Global Bonds | 20% |

Bond, Short-term Treasuries | 20% |

Cash | 20% |

With this level of diversification, ISC aims to create a stable foundation that withstands market volatility and inflationary pressures.

In a Twitter Space with Bluejay Finance, the ISC team mentioned that this kind of allocation with the most inversely correlated assets draws inspiration from Ray Dalio's All Weather Portfolio but with much decreased risks to optimize more on stability instead of profits.

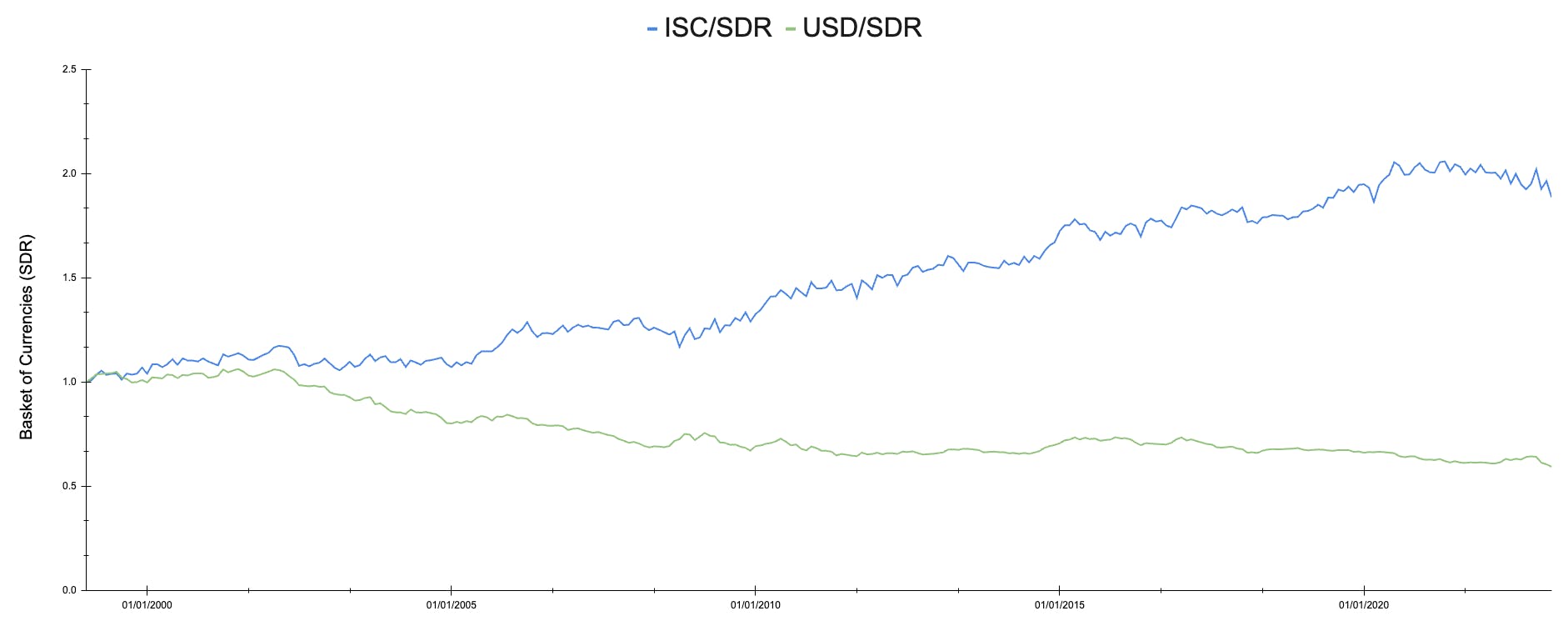

To demonstrate the efficacy of its approach, ISC conducted a backtesting analysis covering the period from 1999 to 2023, comparing ISC's purchasing power against the US Dollar. The results were enlightening:

US Dollar's Declining Purchasing Power 📉: Over the tested period, the US Dollar experienced a substantial loss, with its purchasing power dwindling by almost half. This erosion highlights the challenges faced by fiat currencies when it comes to maintaining value over time.

ISC's Strengthening Purchasing Power 📈: In stark contrast, ISC demonstrated remarkable resilience, almost doubling its purchasing power during the same period. This outcome underscores the effectiveness of ISC's diversified asset basket in safeguarding against inflationary risks and preserving value.

(Source: ISC Team's Backtesting Analysis: ISC vs. USD)

ISC's Stability Against De-dollarization [ ✅ ]

By encompassing global asset classes, ISC ensures that its stability is not solely contingent on the value of a single currency nor on the performance of a single government or economy.

This approach diminishes vulnerability to de-dollarization movements and enhances the long-term resilience of the stablecoin ecosystem.

ISC acknowledges the possibility of the allocation's value decreasing, like any other investment. However, the diversified asset basket serves as a robust defense mechanism that even in the event of a downfall in one asset class, the impact is less severe compared to relying on a single currency, even if that currency is the US dollar.

This ISC's paradigm shift encourages users to rethink stability—that it should not be confined to preserving the dollar value alone; it should also encompass preserving the purchasing power and adaptability of funds in an ever-changing financial world.

III-B. Realigning Risk-Reward Distribution: A Fair Approach

Paradigm: More risk for the users, more rewards for the issuer

ISC's Paradigm Shift: Balanced risk and rewards for the users and the issuer

(Source: Blockworks)

The greater the risk, the greater the potential return—it's a widely known principle. Yet when buying into stablecoins today, why does it appear that users bear all the risks and reap little to no rewards?

On the flip side, issuers can generate more than $7.5 million in profit every day.

With ISC trying to reinvent the wheel, here's one more thing they're assuring its users: profits made by the ISC Reserves are baked back into the price of ISC.

How does it work?

The ISC Target Price is computed as the total value of the ISC Reserve Basket at the present day, where p is the asset price, and q is the quantity of that asset.

\(ISC_{TP} = ∑ p_{asset}*q_{asset}\)

(see also III-A ISC's Stability Against De-pegging section above*)*

How does ISC sustain its operations?

To sustain ISC's operations and ensure its longevity, it secures the following method of funding:

For ISC Reserves: ISC Reserve Incentive Structure - The ISC Reserve Basket undergoes a daily reduction of 0.5%/365 (with community oversight—see Section III-C), which in turn reduces the assets required by a small amount. To cover ISC Reserve operating costs, the assets that are surplus to the requirements of the ISC Reserve Basket are used.

For ISC Issuer: ISC Issuer Interest Rate - ISC Issuer charges an interest rate of 0.0~1.0% (with community oversight—see Section III-C) on ISC Loans.

III-C. Leveling Up Transparency: Better than Attestation

Paradigm: Attestation as users' best shot at transparency

Paradigm Shift: Commit to Audit + Promote Community Oversight

Now, let's dive into the complex world of stablecoins and their elusive transparency.

It's a real challenge.

Because at best, stablecoin issuers showcase transparency by only providing third-party attestations on their Reserve Report.

Now, you might be wondering, what's the big deal?

Attestations provide a certain level of visibility, but they have inherent limitations in their scope.

Imagine this: You have a security camera installed at the front entrance of the building.

The security camera can capture the activities happening on a specific area at a specific time, but it remains blind to what happens in the other parts of the building, like the back entrance, the hallways, or rooms hidden from its view.

The camera's limited scope restricts its ability to capture the complete picture of what's really going on inside.

Well, the security camera is like the accounting firms tasked to do the attestation report. They're only given limited access.

While the front entrance of the building is the stablecoin issuers' Reserve Report. It can only share one side of the story.

So while attestations offer some transparency within their boundaries, audits offer a more comprehensive and detailed view by uncovering hidden risks, mismanagement, or potential fraud.

Recognizing the value of audits, ISC not only commits to regular audits but goes the extra mile by empowering the community to choose the auditor quarterly through a Decentralized Autonomous Organization (DAO) governed by ISC users. By leveraging the ISC Governance Token ($IGT), the DAO members gain community oversight and the following voting rights, at a minimum:

The exact composition of the underlying basket of assets (see Section III-A)

Electing an ISC Community Auditor (as discussed on this section)

Recalling ISC loans from a ISC Reserve (see Section III-A)

ISC Reserves’ Incentive Structure (see Section III-B)

ISC Issuer Interest Rate (see Section III-B)

Grant Proposals

IV. How to get $ISC and $IGT

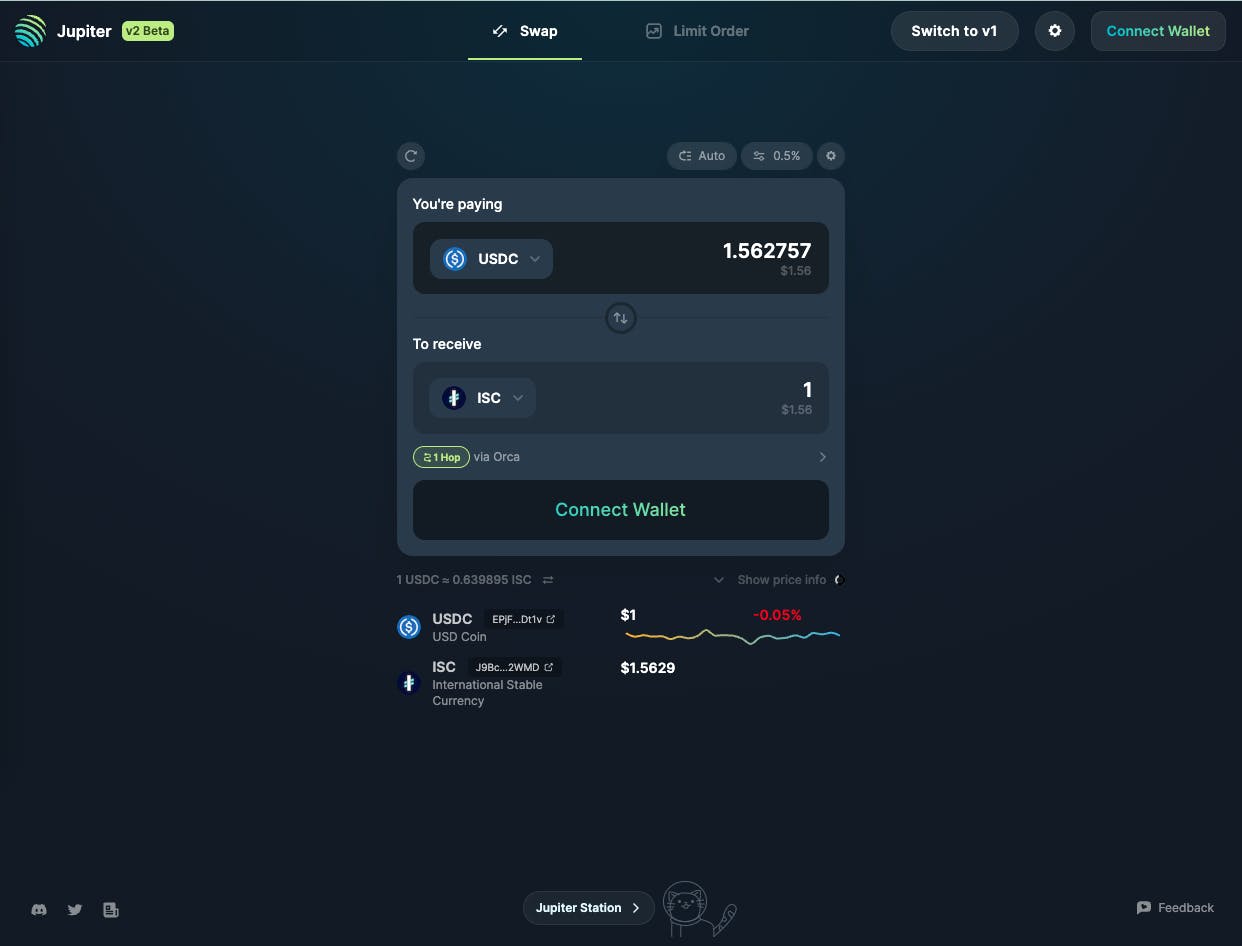

Swap to $ISC

Go to https://jup.ag/ (Alternatively, you may use Phantom Wallet's Swap Feature)

Connect your wallet

Swap any of your Solana Program Library (SPL) tokens to $ISC

Note: For best practice, confirm the correct $ISC mint address from ISC's website: J9BcrQfX4p9D1bvLzRNCbMDv8f44a9LFdeqNE4Yk2WMD

$IGT Airdrop ✨

As $IGT's primary use case is to decentralize ISC to the greatest extent possible, the team plans to airdrop the bulk of $IGT to $ISC holders.

As indicated on their latest whitepaper, 5 million $IGT will be distributed to $ISC holders each month, proportional to the length of time and amount of $ISC held by the user. No staking is required.

As of writing, we're still very early into the project as $ISC just launched two months ago (March 2023) and currently with no more than 230 holders and no more than 230,000 $ISC in current supply.

So if you want to own $IGT and gain oversight into ISC, currently the easiest way is to just hold $ISC. On a Twitter Space with Bluejay Finance, the ISC team mentioned that the $IGT airdrop criteria may possibly change in the future and may gear towards airdropping tokens based on decentralize app (dApp) interactions.

Based on the latest published $IGT Launch Plan, $IGT is targeted for launch between 2023 Q4 and 2024 Q2.

V. ISC for Building Through Volatility

Among the various use cases of ISC, what excites me the most is its potential as treasury reserves.

ISC's stability and potential for value appreciation make it an ideal choice for treasury reserves, particularly for Web3 projects navigating the volatile crypto market. The extended timelines of project development require sustainable funding despite market downturns, as seen in the recent bear market that forced many projects to halt operations.

By diversifying treasury reserves with ISC, Web3 projects can mitigate the risks associated with inflation and volatile cryptocurrencies.

VI. ISC's Approach to Potential Challenges

As ISC emerges as a formidable player in the stablecoin landscape, it is poised to face challenges inherent to the cryptocurrency industry as a whole.

Let's explore some of the most pressing challenges and how ISC aims to address or minimize the risks of each:

Interoperability - While ISC is currently built on Solana, the team recognizes the importance of interoperability within the broader blockchain ecosystem. To enable seamless integration with other networks, ISC has plans to develop a cross-network bridge connecting Ethereum, Arbitrum, and Aptos. Unlike traditional bridge tokens that carry the risk of bridge hacks, ISC aims to utilize the Wormhole protocol for secure token bridging. By prioritizing user safety and minimizing bridge risks, ISC ensures that users can confidently engage with the platform's interoperability features.

Legalities and Regulations - Navigating the complex landscape of legalities and regulations poses a significant challenge for everyone in crypto. But stablecoins have garnered increasing attention from regulators worldwide, and ISC is not immune to this. Recognizing this fact, ISC ensures the following, at a minimum, to decrease their regulatory exposure:

ISC's area of jurisdiction is outside of US, since it has more stringent regulatory requirements for stablecoins

establishing clear separate entities for ISC Issuer (ISC Foundation) and ISC Reserves (various independent brokerage firms)

relinquishing the ultimate decision for the ISC Reserve Basket to the DAO

Alignment of Ethos and Monetary Philosophy to the DAO - ISC's emphasis on community governance and decision-making through a DAO introduces a challenge that all DAOs eventually face. It requires aligning the ethos and (monetary) philosophy of the project with the diverse perspectives and interests of community members. Balancing the need for collective decision-making while maintaining the stability and growth objectives of ISC will necessitate thoughtful governance mechanisms and effective communication channels. To address this, ISC carefully considers its $IGT distribution and tokenomics.

While these challenges are significant, they present opportunities for ISC to innovate and spearhead paradigm shifts in the space.

VIII. Closing Thoughts

Doing this deep dive bounty has undoubtedly challenged my existing notions of stability, risk-reward distribution, and transparency within the stablecoin landscape.

Additionally, by embracing decentralized decision-making through a DAO framework, ISC empowers its community to actively participate in shaping the ISC's future. This ethos of inclusion extends to their unique approach of reinvesting reserves gains back into the value of $ISC, setting them apart from traditional stablecoins that operate similarly to banks.

To engage further with ISC and delve deeper into their innovative approach, I encourage you to connect with their responsive and welcoming team on Telegram.

And while you're at it, make sure you also follow them on Twitter to get the latest updates on $IGT tokenomics, airdrop criteria, launch plans, and more.

By joining the conversation, you can contribute your ideas, seek clarification, and actively participate in shaping the future of ISC.

Through their commitment to stability, risk-reward distribution, and transparency, ISC stands as a beacon of innovation, pushing the boundaries and redefining what is possible.

Resources

Bluejay Finance x ISC: Real World Assets Backed Flatcoin Twitter Space